irb malaysia e filing

After these taxes are reduced by any credits claimed under section 3111e and f of the Code 3 sections 7001 and 7003 of the Families First Coronavirus Response Act. What are the latest IRBs guidelines on TPD requirements.

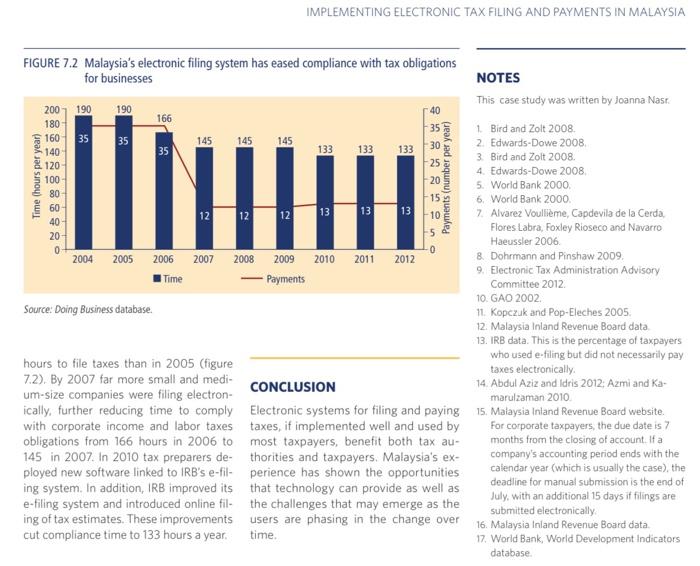

Solved Implementing Electronic Tax Filing And Payments In Chegg Com

Any dormant or non-performing company must also.

. Extension of Time EOT for Filing of Income Tax Return Form under Labuan Business Activity Tax Act 1990 LBATA Letter from IRB - Kelulusan EOT TT2021 Labuan Investment Committee LIC Pronouncement 4-2021. Responses to Information Requests RIR are research reports on country conditions. IHH Healthcare Bhds share price slipped below RM6 for the first time in more than a year on Thursday Sept 22 amid broader market weakness and after Indias Supreme Court refused to lift the stay on IHHs open offer for Fortis Healthcare Ltd sharesIHH fell as much as 15 sen or 246 to RM595 before closing the day at RM6 on a.

Many are shocked to find out the amount of tax they. Deputy Leader of the Malta Labour Party Party Affairs 1992-1997. Original Amended 01092022 No.

Imprisonment for a term not exceeding six. Commonly Faced Problems by Foreigner When Doing Business in Malaysia. All cities other than Kuala Lumpur.

SQL Payroll software ready with all malaysia government report EPF Borang A SOCSO Borang 2 SOCSO Borang 3 SOCSO Borang 8A EIS Borang 1 EIS Borang 1A EIS Borang 2 EIS Borang 2A EIS Lampiran 1 Income Tax CP39 CP39A Income Tax CP 39A Income Tax CP 22 Income Tax EA Form Income Tax EC Form Income Tax CP 8 CP 159 Income Tax e Data Praisi Income Tax. A e-Filing NB. You may also update below details by using our.

Deadline for manual Tax filing is. Damansara Holdings Bhds DBhd wholly-owned subsidiary Damansara Realty Johor Sdn Bhd DRJ has been slapped with an additional income tax bill with penalty of RM2906 million from the Inland Revenue Board IRB. Form to be received by IRB within 3 working days after the due date.

President of Malta Football Association 1982-1992. 3E Accounting Malaysia is offering affordable pricing for company incorporation and formation services in Selangor Kuala Lumpur Penang Malaysia. Claim Your RM5000 SME Digitalization Grant.

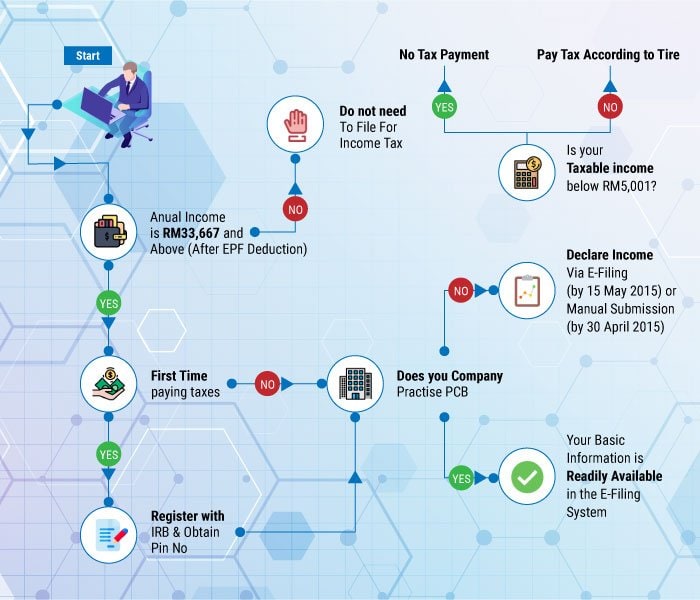

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Most people however are quite confused with the PCB and income tax filing. E-Filing is not available for Form TJ.

ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. All filing and payment must be done at the IRB.

And the reconciliation of the advance payment at the time of filing the employment. 15 th April 2020. B Via postal delivery.

KUALA LUMPUR Sept 22. Earlier RIR may be found on the European. Failure to do so IRB will render an employer liable to.

Legal Advisor to Prime Minister of Malta 1996-1997. With effect from 1 st July 2022 change of address can only be made through Notification of Change in Address Form CP600B Pin 12022 and accepted either submitted by hand or by post or update online via e-Kemaskini only. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing.

On 2 December 2021 the IRB published a flowchart to provide further guidance and give more details on the compliance requirements under Paragraphs 131 132 and 133 of the MTPG to help taxpayers with their decision on the level of TPD required under the MTPG. 20-01 20-02 20-03 Level 20 Menara Centara. CONTACT INFO Unit No.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Forms B P BT M MT TF TP and TJ for YA 2021 for taxpayers carrying on a business. KUALA LUMPUR Sept 26.

The database contains a seven-year archive of English and French RIR. Fine of not less than RM200 and not more than RM2000. You may drop in at the IRB head office submit all documents and get an income tax number to proceed with.

The government body which looks over taxing in Malaysia is the IRB Inland Revenue Board of Malaysia. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. Labuan Business Activity Tax.

All companies must file Borang E regardless of whether they have employees or not. Tax Incentive For Organising Conferences In Malaysia. Within 15 days after the due date.

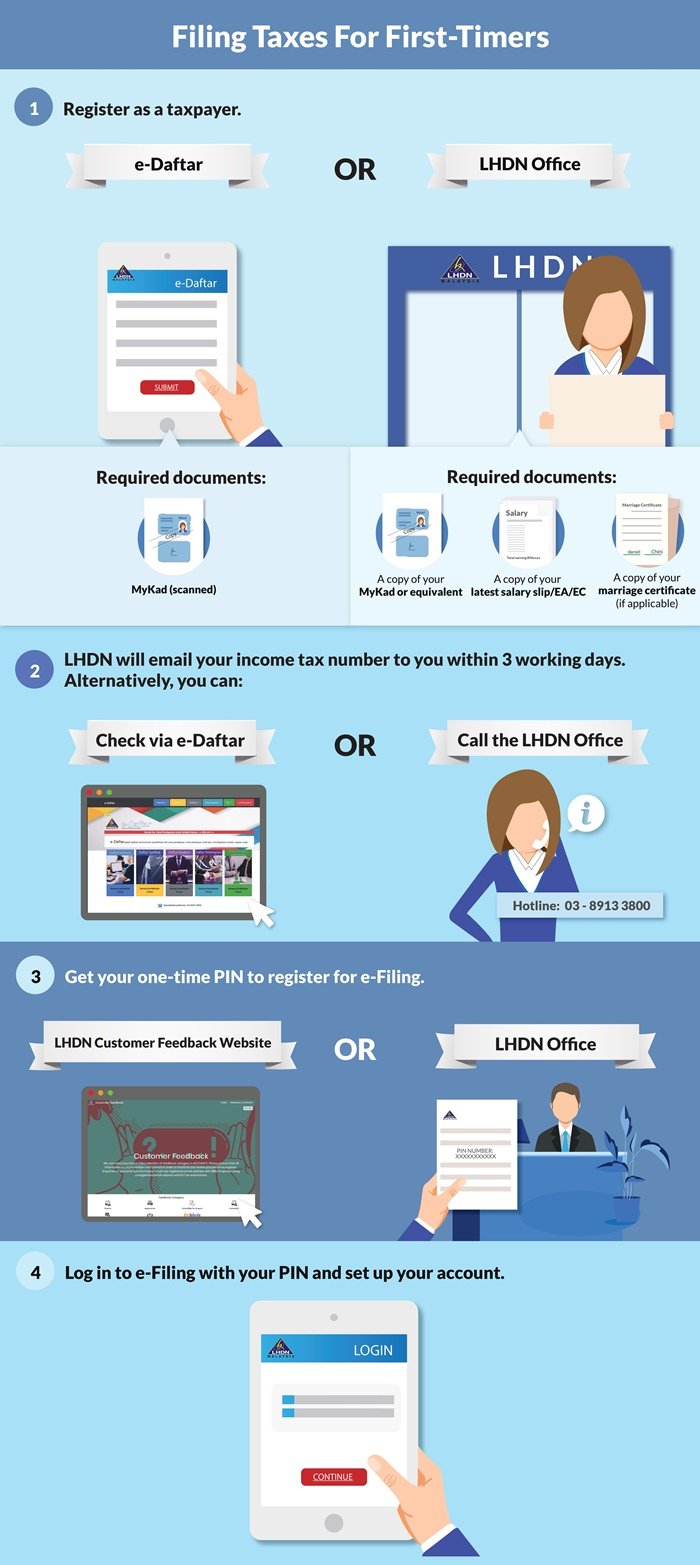

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. The employer is obligated to inform the assessment branch of IRBM by filing and submitting a CP 22 form within one month from the date of commencement of an employment. Please bear in mind that you must be registered as Taxpayer prior to registering for ezHASiL e-Filing.

Apply for PIN Number Login for First Time. Time Limit For Unabsorbed Adjusted Business Losses Carried Forward. Thats because Lembaga Hasil Dalam Negeri LHDN Inland Revenue Board of Malaysia IRB mandated this practice for the Year of Assessment YA 2018 and onwards.

Recovery From Persons Leaving Malaysia. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam. This is for years of assessment 2016 to 2019In a filing with Bursa Malaysia on Monday Sept 26 DBhd said the.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. The process of registering is as follows. Taxation Of Foreign Fund Management Company.

Number 1 Hybrid Cloud Accounting Software Cloud Payroll Software in Malaysia. Get Your 60 Days Free Accounting Software Malaysia. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs.

An Expatriate Guide to Starting a Business in Malaysia as Foreigner. They are requested by IRB decision makers. Submission via Customer Feedback Form or email is NOT ALLOWED and will not be processed.

Dr George Abela 1948 Attorney-at-law Malta Eng Marsascala Malta Attorney in private practice specialising in civil commercial industrial and family law. Standard Procedures for Incorporation in Malaysia. Before you can complete your Income Tax Returm Form ITRF via ezHASiL e-Filing the first step you have to take is to Register at ezHASiL e-Filing website.

Former Director Central Bank of. Malaysia follows a progressive tax rate from 0 to 28. April 30 for electronic filing ie.

Pdf E Government Policy Ground Issues In E Filing System

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

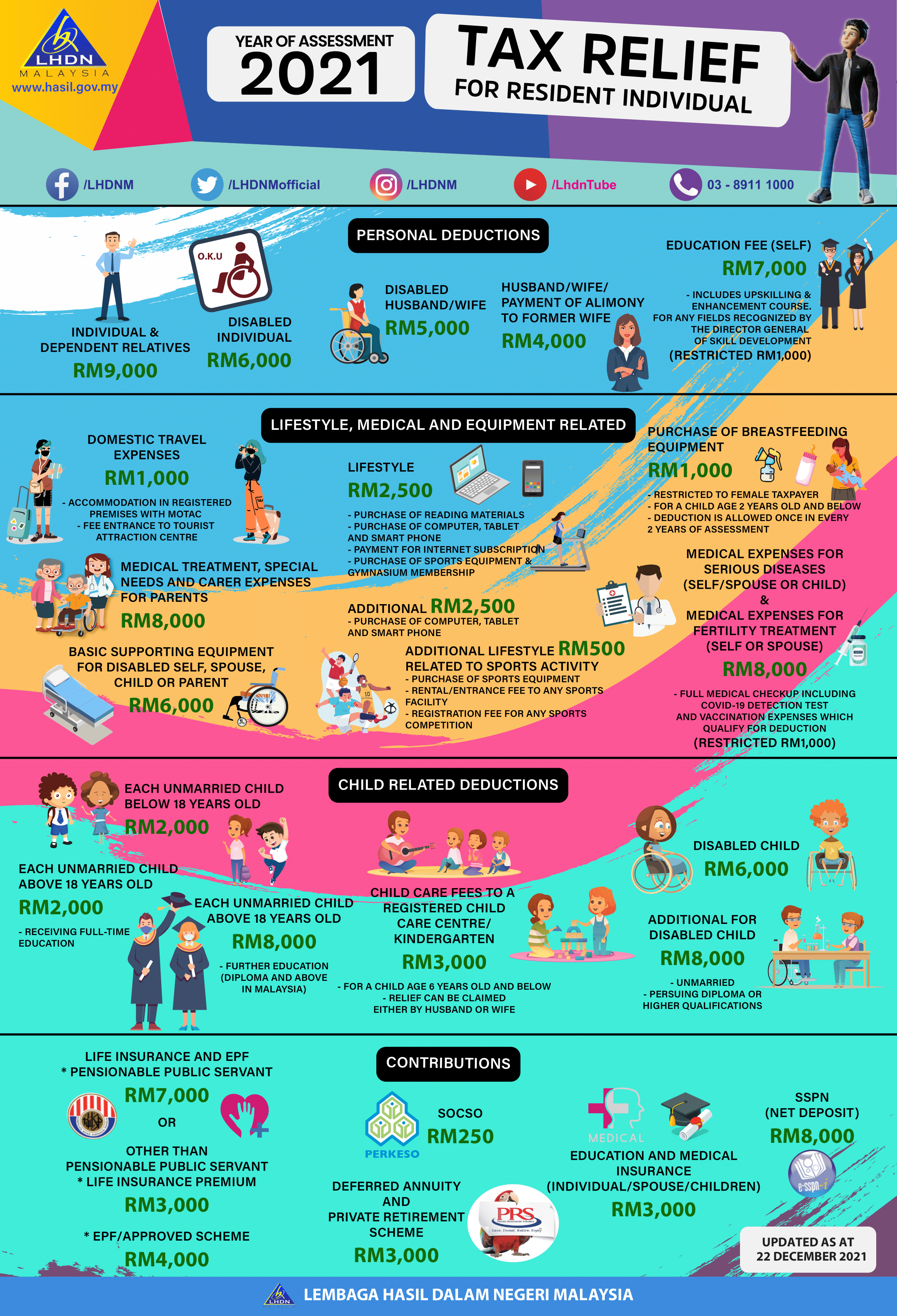

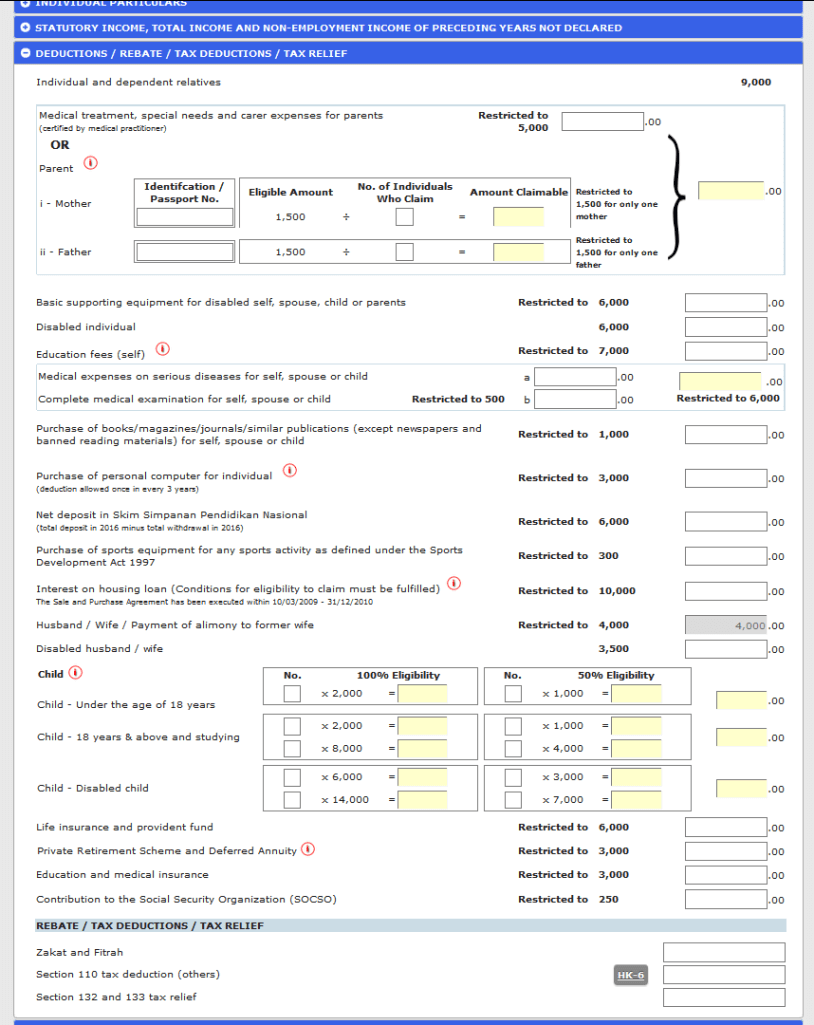

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Personal Income Tax E Filing For First Timers In Malaysia

Pdf Profiling Online And Manual Tax Filers Results From An Exploratory Study In Penang Malaysia

Ibima Publishing Tax E Filing Adoption In Malaysia A Conceptual Model

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Malaysia Personal Income Tax Guide 2021 Ya 2020

Irb May 15 Deadline To Submit Tax Returns Via E Filing Malay Mail

Guide To Using Lhdn E Filing To File Your Income Tax

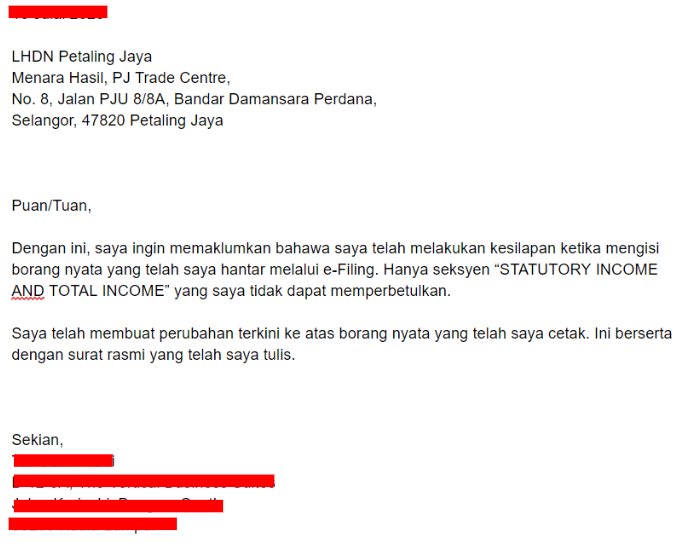

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

How To File Your Taxes For The First Time

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Comments

Post a Comment